Cut through the headlines and analyze what recent economic indicators (inflation, employment, GDP) actually mean for everyday people.

Introduction

The global economy is a complex beast. Headlines daily scream about inflation surges, job growth, or GDP fluctuations, often leaving the average person confused and unsure what these numbers mean for their daily lives. At TrueReports, we aim to cut through the jargon, hype, and fear-mongering to provide a clear-eyed understanding of the economic indicators shaping our world today.

In this deep-dive post, we will unpack key metrics like inflation rates, employment figures, and GDP growth. More importantly, we’ll explore what these numbers mean for your paycheck, your shopping cart, your job security, and your family’s financial future. Because economic data isn’t just numbers on a chart—it directly impacts how you live, work, and plan ahead.

1. Understanding the Economic Landscape: Beyond the Headlines

Economic news cycles are dominated by a few key indicators:

- Inflation: The rise in prices over time.

- Employment data: How many jobs are created or lost, and unemployment rates.

- Gross Domestic Product (GDP): The total economic output, a measure of growth or contraction.

1.1 Why These Indicators Matter

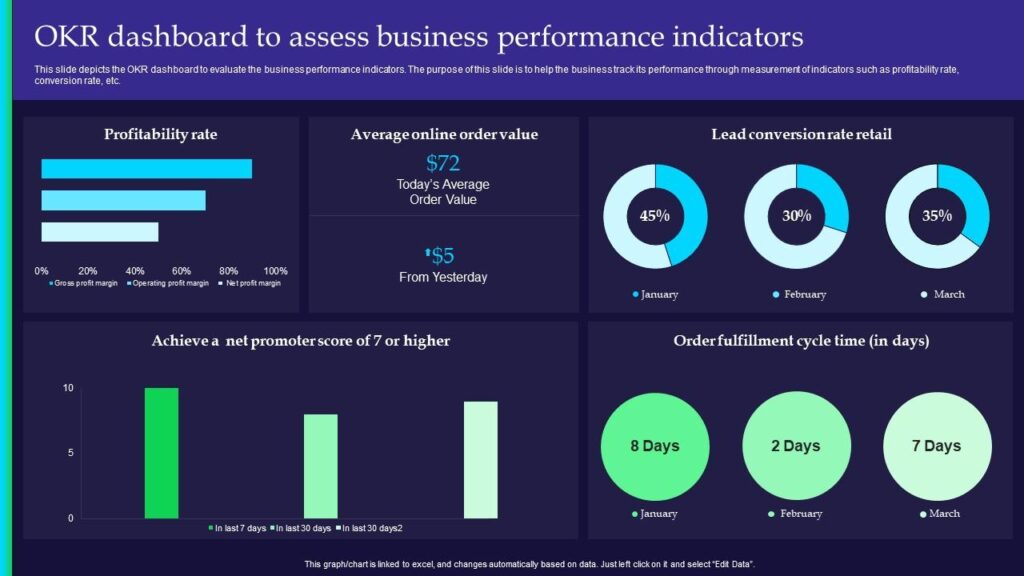

These metrics are the pulse of the economy. Policymakers, businesses, investors, and consumers all watch them closely to make decisions—from interest rates to hiring plans to spending habits.

But these numbers have nuances often lost in media simplification:

- Inflation can vary drastically by category (energy vs. food vs. housing).

- Employment figures often miss underemployment or labor force participation nuances.

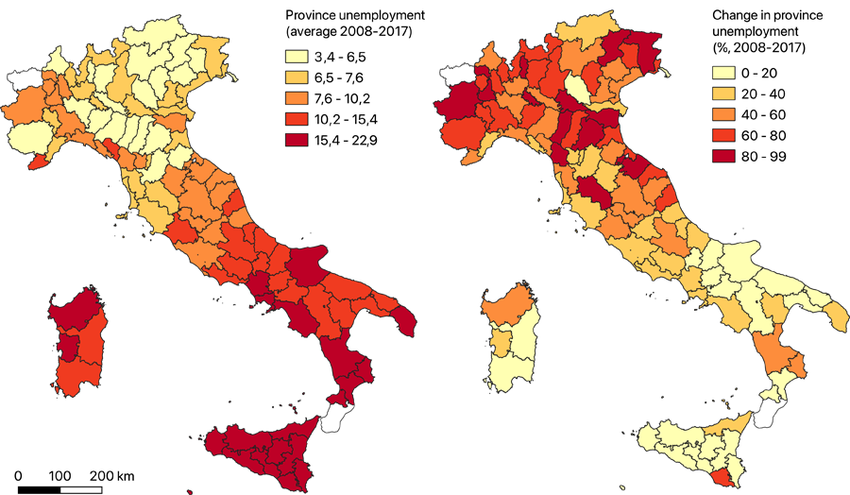

- GDP growth may hide regional disparities or income inequality trends.

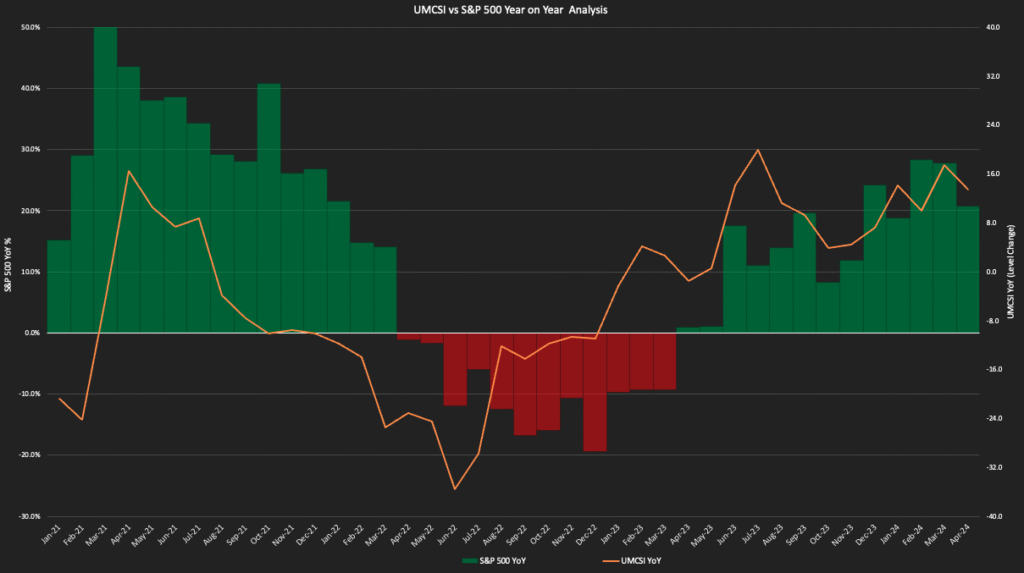

2. Inflation: The Silent Wallet Squeeze

2.1 What is Inflation?

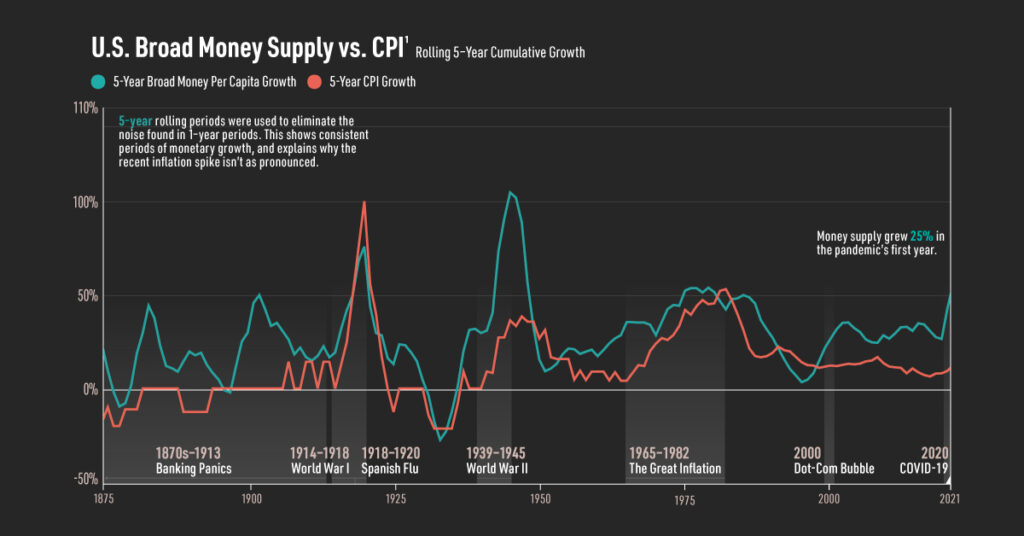

Inflation measures how much prices for goods and services increase over a period, typically a year. Central banks target moderate inflation (around 2%) as a sign of a healthy economy.

2.2 Recent Trends

- After years of historically low inflation, many countries experienced sharp increases since 2021. For example, U.S. inflation hit highs not seen in four decades, peaking around 9% in mid-2022 before easing.

- The causes included pandemic-related supply chain disruptions, energy price shocks, and pent-up demand.

2.3 What the Numbers Don’t Tell You

- Headline inflation vs. Core inflation: Headline includes volatile food and energy prices, which fluctuate a lot; core inflation excludes these to provide a steadier view.

- Inflation is not uniform: Rent and housing prices surged for many, while electronics prices dropped due to technological improvements.

2.4 How Inflation Affects You

- Cost of Living: Everyday essentials become more expensive—groceries, gas, utilities.

- Wage Growth: If wages don’t keep pace with inflation, real income falls, reducing purchasing power.

- Savings and Debt: Inflation erodes savings value but can reduce the real burden of fixed-rate debt.

- Interest Rates: Central banks raise rates to combat inflation, increasing borrowing costs.

Real-World Example: The Grocery Basket

Between 2021 and 2024, the average cost of groceries increased by approximately 15%. For a family that previously spent $500 monthly on food, this means an extra $75 out-of-pocket — money that could have gone to savings or other expenses.

3. Employment: Jobs, Wages, and Labor Market Realities

3.1 What Does Employment Data Show?

Key employment metrics include:

- Unemployment Rate: The percentage of the labor force without jobs but actively seeking work.

- Labor Force Participation Rate: How many people are working or actively looking for work, out of the total eligible population.

- Job Growth: Number of new jobs added or lost during a period.

3.2 The Great Reshuffle & Underemployment

- Post-pandemic, many countries faced “The Great Reshuffle” — massive job turnover as workers re-evaluated career paths, work-life balance, and job satisfaction.

- Unemployment numbers don’t capture underemployment — people working part-time involuntarily or jobs that underutilize skills.

3.3 Wage Growth vs. Inflation

While job numbers recovered quickly after the pandemic slump, wage growth has been uneven and often insufficient to keep pace with inflation, leading to a “real wage” squeeze for many workers.

3.4 Employment’s Impact on Daily Life

- Job security and income stability affect mental health, spending, and long-term planning.

- Access to good jobs influences social mobility and economic inequality.

- Labor shortages in certain sectors (healthcare, tech, manufacturing) drive regional disparities.

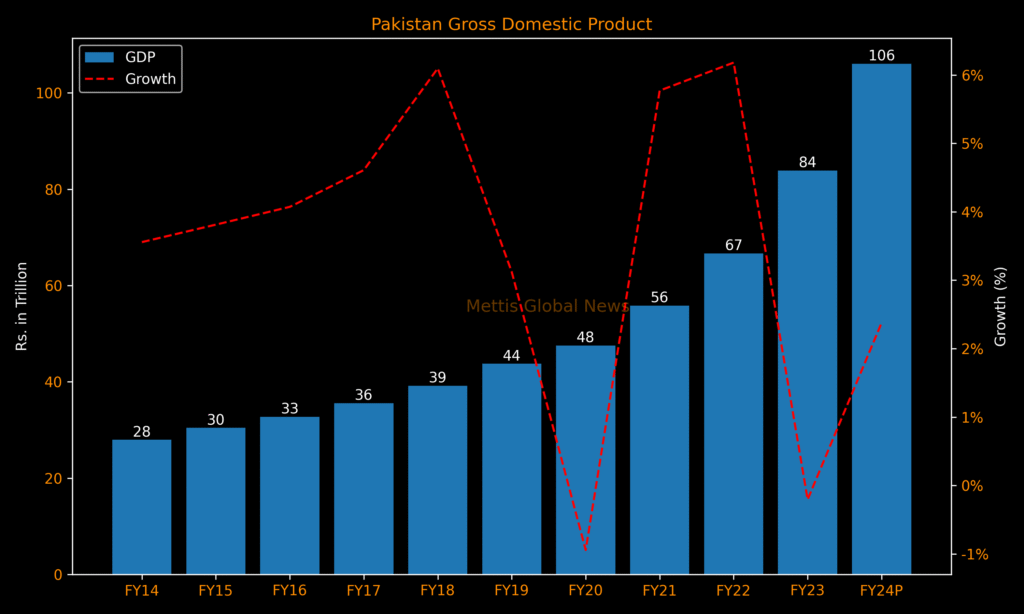

4. Gross Domestic Product (GDP): The Bigger Picture

4.1 What Is GDP?

GDP measures the total value of goods and services produced within a country’s borders. It’s the broadest indicator of economic health and growth.

4.2 Recent GDP Trends

- Many economies experienced sharp contractions in 2020 due to COVID lockdowns.

- Recovery was uneven, with some sectors booming (tech, e-commerce) and others lagging (travel, hospitality).

- Growth rates have moderated recently, reflecting global uncertainties like inflation pressures, geopolitical tensions, and energy crises.

4.3 GDP Growth and Income Distribution

GDP growth doesn’t always mean everyone benefits equally. Income inequality means gains often concentrate among the wealthiest, while wage stagnation persists for many.

5. Cutting Through the Noise: What the Data Really Means for You

5.1 Inflation and Your Budget

You might notice higher prices at the pump or checkout but wonder if wage increases offset these costs. Data shows many workers’ paychecks have not fully caught up, leading to tighter household budgets and changes in spending habits (cutting discretionary expenses, seeking cheaper alternatives).

5.2 Employment and Job Security

Although unemployment rates may look low, many workers feel precarious due to changing job demands, gig economy growth, and automation threats. Additionally, some sectors face chronic labor shortages, which can mean more job openings but also pressure on existing workers.

5.3 GDP Growth Doesn’t Always Reflect Your Reality

National GDP growth might be positive, but if you live in a region or industry that’s shrinking, your personal economic outlook might be quite different. Furthermore, GDP doesn’t measure quality of life factors like work-life balance, environmental health, or social cohesion.

6. What Experts Are Saying: Diverse Views on the Economic Outlook

Economists and analysts vary in their interpretations:

- Some warn inflation may persist longer, necessitating continued interest rate hikes, risking recession.

- Others argue inflation pressures are easing and labor markets remain resilient.

- The debate includes concerns over global supply chains, climate change impacts, and technological disruption reshaping industries.

7. How to Protect Yourself Financially Amid Economic Uncertainty

7.1 Budget Smartly

Track your spending, prioritize essentials, and build emergency savings.

7.2 Invest Wisely

Diversify portfolios, consider inflation-protected assets, and avoid panic selling.

7.3 Upskill Continuously

Adapt to changing job markets by learning new skills and seeking growth sectors.

7.4 Monitor Economic Data

Stay informed but avoid media hype—focus on credible sources and long-term trends.

8. Looking Ahead: What to Watch in the Next 12 Months

- Inflation trajectory: Will it stabilize near central bank targets?

- Employment shifts: Will labor participation rebound?

- GDP growth: How will geopolitical and climate factors influence global economies?

- Policy responses: Interest rates, fiscal stimulus, social programs.

Conclusion

Economic indicators can seem distant and abstract, but they shape the fabric of daily life in profound ways. By understanding the nuances behind inflation, employment, and GDP, you’re better equipped to navigate the challenges and opportunities ahead.

At TrueReports, we’re committed to delivering clear, data-driven insights that empower you to make informed decisions—not just react to headlines.

Stay curious, stay informed, and take control of your economic reality.

Appendix: Data Sources & Further Reading

- U.S. Bureau of Labor Statistics (BLS)

- Federal Reserve Economic Data (FRED)

- World Bank Global Economic Prospects

- OECD Economic Outlook

- IMF Inflation Reports

- Consumer Price Index (CPI) Historical Data

- OECD Employment Outlook