Understanding how government budgets are allocated — and where the public actually sees the impact.

Introduction

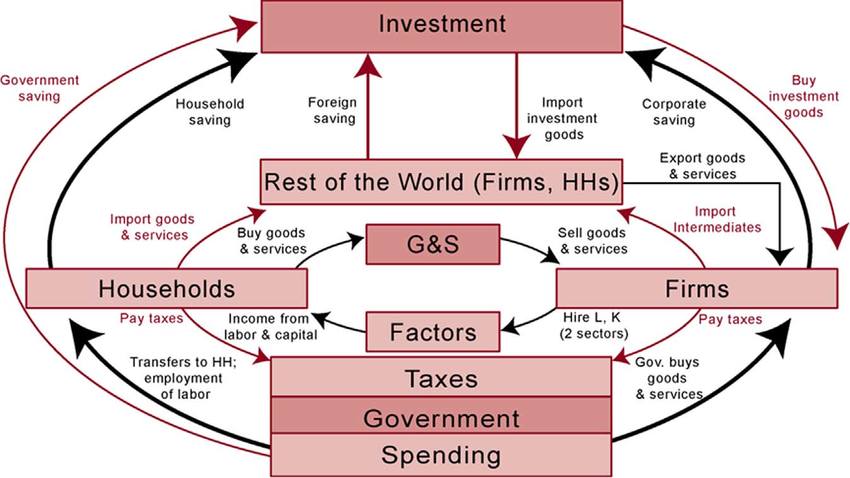

Taxes are an undeniable part of modern life. Whether it’s income tax, sales tax, or property tax, millions of citizens contribute a portion of their earnings to government coffers. But a common question lingers: Where exactly does all that tax money go?

At TrueReports, we believe transparency is essential to foster trust between the government and its citizens. This detailed report aims to break down government budgets clearly and visually, demystifying how your tax dollars are allocated and the real-world impacts they create — or sometimes fail to create.

1. Understanding Government Budgets

1.1 Types of Taxes

Before diving into spending, it helps to understand the sources:

- Income Tax: Paid by individuals and corporations, often progressive in nature.

- Payroll Tax: Fund Social Security and Medicare programs.

- Sales Tax: Charged on goods and services, varying by state/locality.

- Property Tax: Levied on real estate, supporting local governments and schools.

- Excise Taxes and Others: On gasoline, tobacco, alcohol, etc.

Each of these contributes to federal, state, and local government budgets, which are managed separately but often overlap in services.

1.2 Federal vs. State vs. Local Budgets

- Federal: Handles national defense, social welfare, infrastructure, and more.

- State: Manages education, transportation, public safety, health services.

- Local: Focuses on policing, firefighting, schools, sanitation, zoning.

Each level has distinct responsibilities and revenue sources.

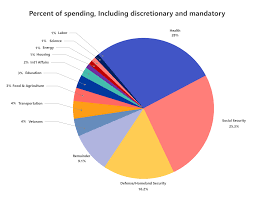

2. Federal Government Spending Breakdown

The federal government accounts for the largest share of public spending in many countries, including the U.S.

2.1 Major Categories (U.S. Example)

- Social Security: ~24%

- Healthcare (Medicare, Medicaid): ~25%

- Defense & Security: ~15%

- Interest on Debt: ~8%

- Education & Training: ~6%

- Infrastructure & Transportation: ~3%

- Other (Science, Environment, Agriculture, etc.): ~19%

2.2 Social Security and Welfare

Social Security provides retirement benefits for millions of Americans. Medicaid and Medicare cover healthcare for seniors, disabled persons, and low-income individuals.

- Impact: These programs reduce poverty among seniors and increase access to healthcare.

- Controversy: Aging populations and rising healthcare costs challenge sustainability.

2.3 Defense Spending

Defense budgets cover military operations, personnel, equipment, and research.

- Global Comparison: The U.S. defense budget surpasses the next several countries combined.

- Debate: Critics argue excessive military spending crowds out social programs.

2.4 Interest on Debt

Governments borrow money to fund deficits, paying interest on the national debt.

- Fact: Interest payments consume a growing portion of the budget, limiting spending flexibility.

3. State and Local Government Budgets

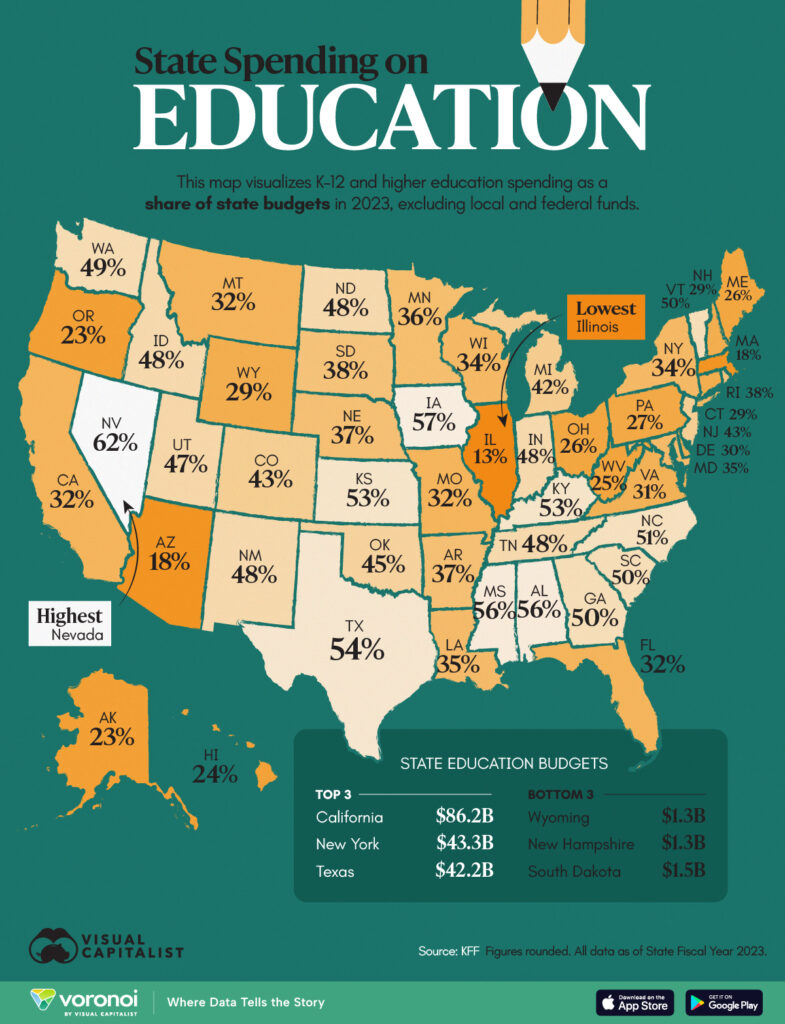

3.1 Education

State and local governments primarily fund public K-12 and higher education.

- Percentage of Budgets: Often 30-40% at local levels.

- Impact: Directly affects school quality, teacher salaries, infrastructure.

3.2 Public Safety and Justice

Police, fire departments, courts, and corrections constitute a significant expenditure.

- Balance: Communities debate funding between policing and social services.

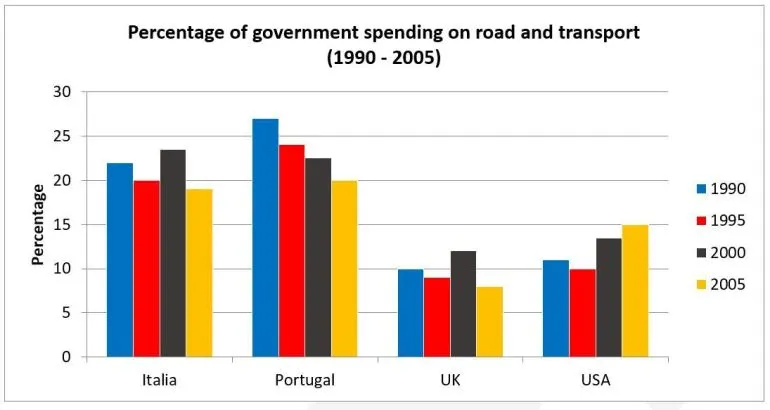

3.3 Transportation and Infrastructure

Road maintenance, public transit, and utilities fall under this category.

- Challenge: Aging infrastructure demands increased investment.

3.4 Health and Social Services

State Medicaid programs and local health initiatives support vulnerable populations.

4. Where Does the Public See the Impact?

4.1 Tangible Benefits

- Roads you drive on and public transit you use.

- Public schools educating children.

- Healthcare services for seniors and low-income individuals.

- National defense ensuring security.

4.2 Areas of Concern

- Overcrowded schools in many areas.

- Aging, poorly maintained infrastructure.

- Homelessness and poverty despite spending on social programs.

- Debates over police funding and community safety.

5. Common Misconceptions About Tax Spending

5.1 Myth: “Most of My Taxes Go to Waste”

While inefficiencies exist, audits show that a large share funds essential services.

5.2 Myth: “The Government Just Prints Money”

Deficits and borrowing impact national debt but money printing is controlled by central banks.

5.3 Myth: “Taxes Only Fund Bureaucrats”

Tax money funds frontline workers: teachers, firefighters, healthcare providers.

6. How to Influence Budget Priorities

6.1 Voting

Local elections often shape education and policing budgets.

6.2 Participating in Public Forums

Attend city council meetings or budget hearings.

6.3 Contacting Representatives

Express your priorities and concerns.

7. The Future of Tax Spending: Trends to Watch

7.1 Growing Healthcare Costs

Innovation and aging populations will pressure budgets.

7.2 Infrastructure Renewal

Federal and state stimulus packages increasingly target infrastructure.

7.3 Climate and Environment

Increased investment in renewable energy and disaster preparedness.

8. Conclusion

Your tax dollars are a critical source of funding for a wide range of services and responsibilities, from social safety nets to national defense. While the picture is complex and sometimes frustrating, understanding how budgets are allocated can empower you to participate more effectively in the democratic process.

At TrueReports, we strive to bring clarity to topics that impact your daily life. Now that you know where your tax money goes, what questions do you have for your representatives? How do you think priorities should shift?

Appendix: Additional Resources

- U.S. Treasury – https://home.treasury.gov/

- Congressional Budget Office – https://www.cbo.gov/

- National Priorities Project – https://www.nationalpriorities.org/

- State and local government websites (varies by region)