While headlines scream “housing crash” or “rent armageddon,” meaningful shifts happen quietly—transforming neighborhoods, reshaping affordability, and redefining urban living. At TrueReport, we spotlight six underreported trends gaining momentum in 2025:

1. Suburban & exurban migration

2. Entry‑level supply bottlenecks

3. Adaptive reuse via office‑to‑residential conversions

4. PropTech & live‑work evolution

5. Zoning reform and middle‑housing

6. Global parallels: emerging hubs

Each section features data-driven analysis and image placement for visual clarity.

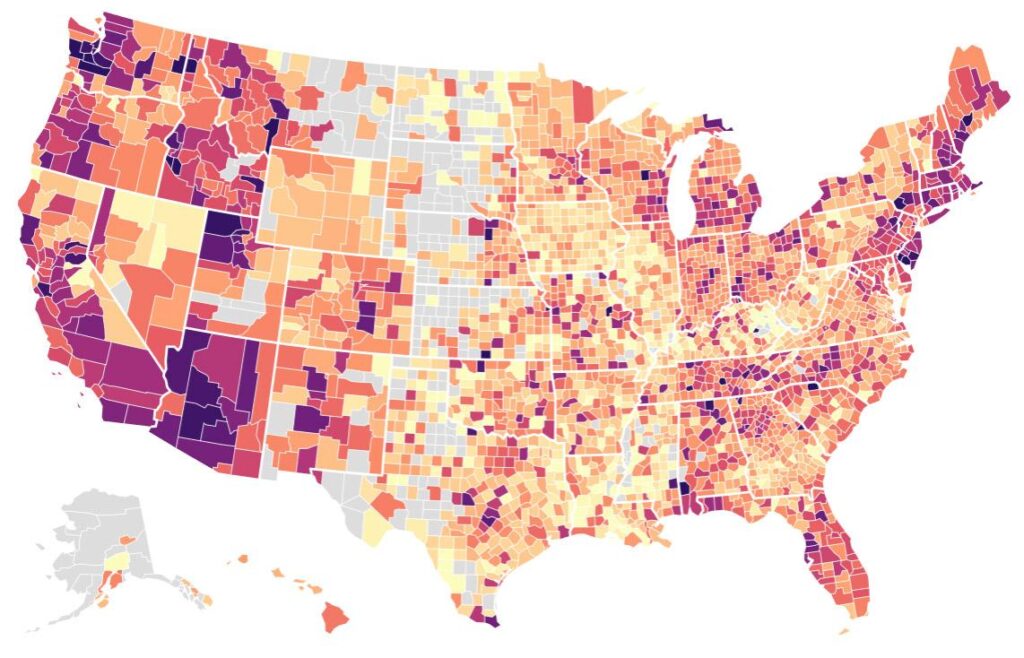

1. Suburban & Exurban Migration 🏡

1.1 The Quiet Shift

Remote work, space-seeking families, and affordability concerns have driven a 15–20% surge in suburban home prices since 2020—a rate dwarfing urban growth (~10%) . Exurban areas (beyond suburbs) saw ~16% population growth, while many city cores are flat or declining .

1.2 Listings & Buyer Leverage

Suburban inventory rose 38% year‑over‑year, easing buyer competition and offering negotiation leverage

1.3 Hidden Costs of Sprawl

New suburban units typically cost $20–25 k per home in infrastructure (roads, utilities, schools)—costs local governments eventually recoup through taxes .

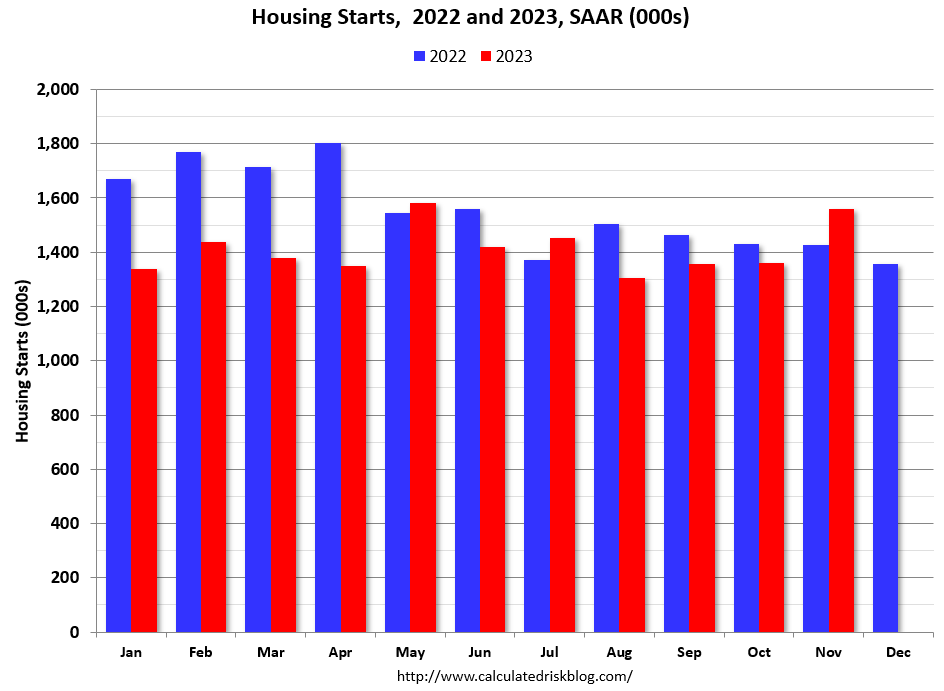

2. Entry-Level Housing Supply Squeeze

2.1 Affordable Starter Homes Plummet

Builders paused on affordable housing; delivery is projected to drop sharply by 2026, worsening first‑time buyer hurdles .

2.2 Construction Data

In May 2025, U.S. housing starts hit a 5-year low, particularly for single-family homes—down ~10% from 2024, while multifamily starts fell ~30% .

2.3 Why This Matters

Without affordable supply, middle‑income buyers face barriers, fueling rental demand and long-term equity loss.

3. Rental Market: Ebb, Flow, and Exurban Boom

3.1 Rent Trends

Rent growth slowed from pandemic highs, but with multifamily completions down 28%, the balance may tilt again .

3.2 Rentals Out to Suburbs

35% of surveyed consumers now choose renting over buying—often in suburbs—making rentals standard living, not a stepping stone . Renters prioritize space, quality, and remote work access.

3.3 Tightening Coming Soon

With fewer new rentals, suburban markets may face upward rent pressure in 2026–27 unless supply recovers.

4. Adaptive Reuse: Office-to-Residential Conversions

4.1 A Trend Gaining Momentum

In 2025, 71,000 office units are projected to convert into housing (fees, approvals pending)—a 357% jump from 2022 .

4.2 Flagship Projects

- 25 Water Street, NYC: over 1,300 units, 25% affordable

- 5 Times Square: ~1,250-unit conversion underway

4.3 Why Conversions Matter

These repurpose vacant offices, increase housing stock efficiently, and revitalize city cores—often faster and more sustainable than new builds.

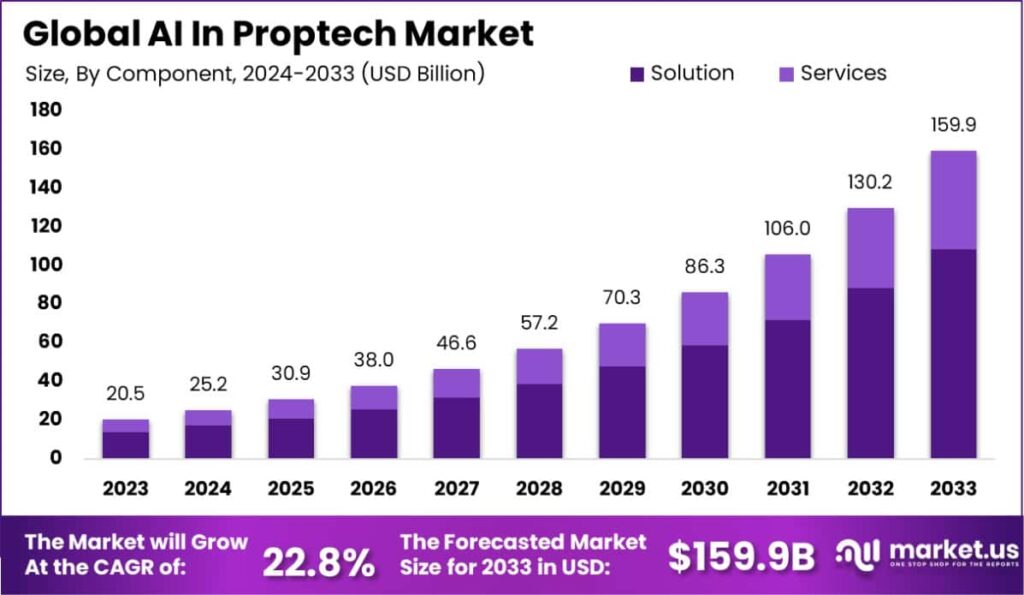

5. PropTech & Live-Work Evolutions

5.1 PropTech’s Quiet Explosion

From $35 B in 2024 to a projected $115 B by 2033, PropTech is remaking how properties are built, managed, bought, and lived in .

5.2 Hybrid Homes & Walkable Communities

Developers are designing “15‑minute neighborhoods”: live‑work‑play zones with integrated coworking and local amenities. Homes featuring office space now fetch 5–10% premiums .

6. Zoning Reform & Middle-Housing

6.1 Beyond Single-Family

Cities like Oregon, Vermont, and Connecticut now allow duplexes/triplexes in formerly single-house districts .

6.2 Early Results

Portland added ~1,400 middle-housing units since 2020—a small but meaningful supply boost .

6.3 Caveats & Risk

In Pittsburgh, inclusion mandates without subsidies caused a 32% drop in building permits locally .

7. Global Snapshots: Emerging Hubs

7.1 Dubai: Tech-Infused Growth

LEED-certified and blockchain-title buildings now represent ~35% of new inventory, with 3D-printed units debuting in 2025 .

7.2 Pakistan: Rental Yield Clarity

Major cities offer strong rental yields (~6–7%) but median renters spend 14–19% of income on rent—indicating pressure .

7.3 Toronto’s Condo-Rental Swell

Toronto added ~25,000 rental condo units in 2024 (representing 41% of all condos)—a major shift .

7.4 Small Town Resurgence

In U.S. micropolitan areas like Ellenville, NY, home prices doubled since 2016 before cooling slightly—signs of remote-work enabled migration .

8. Why These Trends Don’t Steal Headlines

- They develop gradually, not in sudden leaps.

- They involve policy nuances and data details.

- They cut across economics, technology, planning, requiring context to appreciate.

Ignoring them risks misunderstanding where housing affordability, investment, and urban form are heading.

9. What Stakeholders Should Know

| Stakeholder | Trend Impact | What to Consider |

|---|---|---|

| Homebuyers | More suburban options, but comparisons matter | Evaluate long‑term growth & costs |

| Renters | Suburban rentals rising, urban peaks persist | Lock early, weigh metro vs suburban |

| Investors | PropTech + conversions offer new asset classes | Diversify holdings, monitor policy |

| Policymakers | Zoning, conversions, infrastructure matter | Pair mandates w/ investment |

10. Final Takeaways

- Suburban migration accelerated—and infrastructure must catch up.

- Entry-level supply shortage remains critical.

- Office conversions hold significant untapped housing potential.

- PropTech redefines home and investment.

- Middle-housing reforms show promise—but careful execution is essential.

- Global parallels highlight universal housing pressures.

These trends are reshaping real estate quietly—but profoundly.

Conclusion

Real estate is evolving behind the scenes—in neighborhoods, laws, technologies, and under-the-radar markets. At TrueReport, we’re committed to shedding light on these critical developments shaping where and how we live. Whether you’re looking to move, invest, rent, or craft policy, understanding these dynamics empowers better decisions.

Would you like interactive charts, city-by-city comparisons, or thematic downloads (e.g., PropTech primer, middle-housing guide)? Let us know which you’d like to add to TrueReport, and we’ll bring it to life.

References & Data Sources

- Zillow migration & pricing data

- U.S. housing starts & multifamily data

- Fannie Mae rental survey

- Office-conversion pipelines

- PropTech market forecasts

- Zoning reform impacts

- Global property snapshots